The Dynamics of Central Bank Digital Currency

What is Central Bank Digital Currency (CBDC)?

This form of digital currency is backed by the central bank which effectively gives it the status of a legal tender. Legal tender is a form of money that must be accepted if offered in payment of a monetary debt. And herein lies the difference between bank account money and CBDC. Unlike physical cash, money in your bank account is typically not a legal tender. The Euros in your bank account are just a promise of your bank to provide you with physical euro if you so requested. Digital money as we know it is a misnomer. Most e-money in use are liabilities. On the other hand, CBDC represents a change in nature of digital money. A new legal tender that could exist alongside physical cash.

Three Catalysts

Last year Facebook announced Libra, its own digital currency, which would be pegged to a basket of national currencies to hold stable value. Recently the Libra association presented a new version of the project. Instead of being pegged to multiple currencies, Libra introduced an option to have a single currency peg. The essence of this design choice is to allow central banks to utilize Libra’s infrastructure. At the same time, EUR-Libra or USD-Libra should face less regulatory friction in its native markets.

Availability at frequently used platforms would help to accelerate broad CBDC adoption. This approach is, however, particularly problematic for the EU since Europe doesn’t have any fintech companies with significant impact in the digital payments sector. Instead, EU businesses and consumers are served by major US companies (Apple Pay, Google Pay, PayPal). Even if the ECB embraced the idea of hosting its digital currency on private platforms, it will still have to deal with concerns of ceding critical parts of digital economy to US tech giants.

We’ve seen an increase in digital payments as people were forced to stay at home. Fear that the virus might survive on banknotes also led to a decline in cash usage. As the pandemic transformed into an economic crisis, millions of American eagerly awaited the stimulus payments. The need to distribute these payments has fueled interest in a digital dollar. House members proposed two separate bills to utilize the digital dollar for this purpose. While the proposals didn’t make it to the final stimulus package act, they sent a clear signal that the idea of national digital currencies is becoming politically feasible. The crisis has highlighted the need for a dollar with the ability to support faster, more accessible and complex payments.

China’s international investments, trade and financing are heavily dependent on USD as a payment method. To this end Hong Kong serves as a gateway for majority of these transactions. Hong Kong dollar is pegged to US dollar enabling China to access global capital through its port city. This monetary relationship makes Hong Kong irreplaceable as global hub for yuan trade settlement, financing, and asset management. Trump’s administration is now threatening the 36 years old peg system and its fixed exchange rate balance. Exposing this arrangement only underlined China’s commitment to create a digital Yuan. Aiming to promote internalization of Yuan and reshape the current cross border payment system, the digital currency is referred to as the Digital Currency Electronic Payment (DCEP). DCEP distribution is designed to mirror physical cash distribution. Commercial banks first convert some of their deposits at central bank to digital currency and then release it to consumers. China is currently piloting DCEP in three large cities, with Alipay and WechatPay that should both support a DCEP wallet. Although it is unclear if Beijing will use them as distribution channels in the future, given that these two platforms are the bedrock of China’s digital finance it’s certainly a sound possibility.

Impact on global financial system.

The credit cycle is a fundamental process driving modern economies. It refers to contraction and expansion of access to credit. Credit cycle unwinds as commercial banks are expanding or contracting their balance sheets. Banks are expanding their balance sheets by providing new loans, which creates new assets (loan itself) and new liabilities (deposit for a loan). This puts the largest deposit-taking institutions in a very favorable position as the loaned-out funds are automatically re-deposited at their bank. Recycling of liquidity provides these banks with almost limitless capability to finance new loans. There is only one exception that disrupts the liquidity loop, physical cash withdrawal. Depositors that decide to cash out their deposits are forcing banks to finance these withdrawals out of reserves. Any physical cash that is removed from the bank is limiting the bank’s ability to provide new loans.

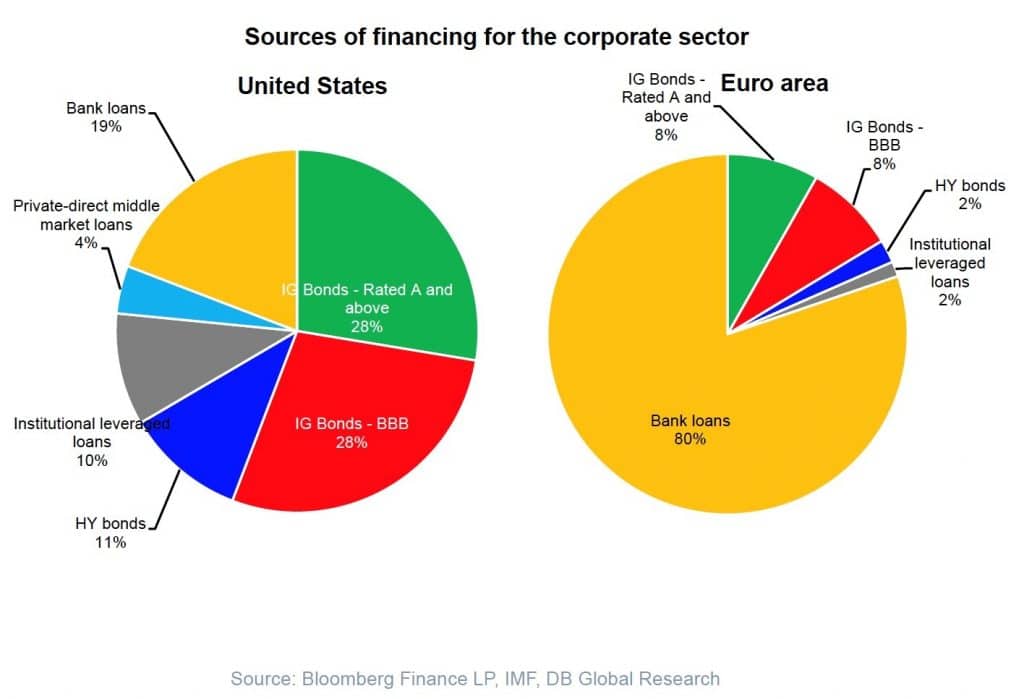

Figure 1: European businesses are much more dependent on bank loans.

Yves Mersch, ECB executive and supervisory board member, in his recent speech on CBDC stated that there are two options for its issuance: a) as a digital token; or b) as deposit account directly with central bank.

- a) Although cash usage is decreasing, 76% of retail transactions in EU still take place through cash. If physical cash were to be banned, this scenario could gain a lot needed traction. Banning physical cash is not as farfetched as it may sound. Several European countries have already constrained cash usability. France has banned cash transactions above 1000 euros, Spain above 2500 euros, Italy above 3000 euros etc. In 2019 ECB ended the issuance of the highest value bank note. In countries such as Belgium, Netherlands, or Sweden most of retail transactions are cashless already. Banning cash removes the one remaining liquidity limitation of the banks, enabling them to further expand their balance sheets. And let’s not forget, we live in times where central banks are contemplating the idea of negative interest rates. Setting a negative interest rate while population has the ability to opt out doesn’t lead to an increase in spending, but to increase in safe sales at most.

- b) Allowing the public to make electronic deposits directly at the central bank would drastically boost the number of ECB’s deposit accounts. ECB would have to establish customer services, cope with AML, consumer protection and confidentiality obligations. Provision of banking services is likely performed more effectively by commercial enterprises. But what’s worse, it would provide a way for people to exit the commercial banking system. Diminishing the ability of commercial banks to provide loans, contracting their balance sheets. On the positive side, such account arrangement would enable targeted distribution of helicopter money, injecting CBDC directly to the populace as opposed to indirect nature of quantitative easing and its many side effects. Still, the risk of credit contraction outweighs all the benefits.

Uncertain about the possible effects on global financial systems and the national economies, central banks remain cautious about adoption of CBDCs. Yet, if other nations decide to digitize their currencies it would make their non-digital counterparts less competitive compared to them. In countries with weak institutions, access to CBDC could facilitate currency substitution. Requiring just an internet connection and login credentials to get a digital Yuan could lead to increased adoption at the expense of USD or EUR. After all, the innovative part of CBDC is not its digital nature, but broad access.