Slovakia Automotive Industry 2.0: The time is now to retool for the e-mobility era

GLOBSEC's new study "Slovakia Automotive Industry 2.0: The time is now to retool for the e-mobility era" has been developed under the AutoFocus Slovakia initiative funded by the European Climate Foundation.

The aim of the project is to support a long-term national strategy for Slovakia’s automotive transformation from ICE to EV production. The findings and recommendations for Slovakia are relevant for the wider Central and Eastern Europe (CEE) region forming Europe’s automotive manufacturing ‘backbone’.

The aim is to encourage a ‘race to the top’ to provide the conditions for attracting EV and battery investment, which includes improved domestic e-mobility perceptions and capabilities. Find below the Executive Summary of "Slovakia Automotive Industry 2.0" and the study in PDF.

Executive summary:

The importance of adapting to a global megatrend

This report presents the results of a research on the impacts of the transition from ICE to EVs on Slovakia’s GDP and employment outlook. The study foresight scenarios that highlight the potential benefits and risks associated with this process, providing policymakers with recommendations on how to cope with the transformative wave in automotive.

The transition towards zero emission vehicles, and especially to battery electric cars (BEV), has been accelerating during 2020-2021, with 74% of Slovakia’s key export markets announcing bans on ICE vehicles sales by 2035. The country’s strong reliance on car manufacturing makes it particularly vulnerable to EV adoption trends. Domestic producers will have to adapt to the changing market situation, regardless of the local rate of the EV take-up, if they are to remain competitive. This is the time when seeds of EV and battery production are being sown, and the window is closing fast. For a substantial EV uptake by 2030, investment decisions need to be made by 2023 and are expected even this year.

Additionally, the current decade is shaking and shaping the car sector, and the international community more broadly, with two unprecedented shocks: the Covid-19 pandemic (2020-2022) and the more recent Russian aggression in Ukraine. The former has presented the industry with adaptation challenges linked to fostered digital and green transitions while upending international supply chains, with consequent trade and production pressures. The war in Ukraine further exacerbated this situation, adding to the huge shortage of semiconductor chips, which already in 2021 cut the automotive industry’s output by 8 million vehicles globally.1 According to preliminary estimates, the conflict is expected to cause global vehicle production to drop by 1.5 million this year, that is 2% less than the 84 million vehicles planned.2

Further disruptions are expected in both global EV battery cell and combustion engine vehicle manufacturing due to the shortage of crucial raw materials mined in Russia and Ukraine. Notably, Russia extracts 40% of the world’s palladium, used in catalytic converters in gasoline-powered vehicles.3 Additionally, concerns over European energy security have intensified due to its structural dependence on Russia’s fossil fuels, with energy prices reaching record highs and fear of disruptions in gas, oil, and coal supplies.4

Against this background, the net impact of the transition to EV production will depend on whether Slovakia will secure enough domestic battery production capacity to meet EVs demand from its export markets. The development of local battery ecosystems would benefit the country in three key ways, by: 1) reducing asymmetrical trade dependencies, subject to supply chain disruptions as shown by the Covid-19 and Ukraine crises 2) transforming the country into an innovation hub within the EU, and 3) offsetting the losses from the ICE vehicle supply chain dismissal.

This is a wake-up call for Slovakia to get behind e-mobility with implementable plans and concrete actions. The green transition offers Slovakia the opportunity to become a leader in EVs production. Building on this opportunity, Slovakia’s automotive industry would modernize with positive effects on GDP and employment.

Based on the results of the modelling process, this report outlines potential implications that could contribute to leveraging the Slovak capacity to move towards EVs production by 2040 and beyond. As the country is facing the greatest challenge to transform its economic anchor and national identity – the passenger vehicle – to meet the global mobility demands of the future, this research aims to become a case study for green industrial transitions across the EU and a regional race to the top in e-mobility.

Key results of the study

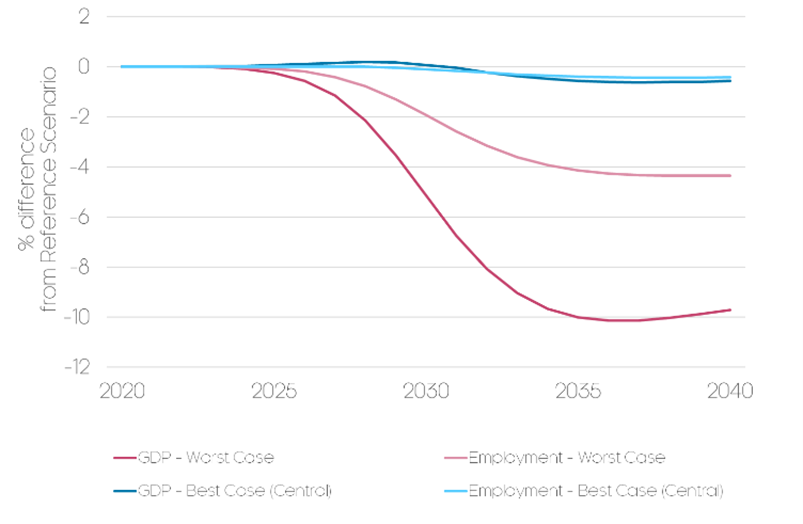

To evaluate the impacts of increasing EVs demand from Slovakia’s export markets, the research builds upon two scenarios. The worst-case or business-as-usual scenario implies that the switch to EVs production does not take place. Conversely, the best-case scenario presupposes that Slovakia adapts its vehicle manufacturing sector to external trends in EVs uptake. Below is a summary of the key outcomes for each scenario.

Worst case or “business as usual”: Slovak car manufacturing sector fails to adapt

- National GDP will be 10% lower than in the best-case scenario

- Total employment will drop by 4.5% on 2020 levels

Best case scenario: Slovak car manufacturing sector successfully switch to EVs production

- Employment will drop by 0.3%

- In the case of the 100% domestic battery production scenario, job losses in the motor vehicle sector would be offset by new EVs production-related jobs

- The required investment in EVs production facilities would be €3.4bn by 2040

- The required investment in battery production capacity stands at €5.6bn by 2040.

Key data are summarized in the following graph:

GDP and employment impact in central scenarios. Source: Cambridge Econometrics.

Policy recommendations for successful automotive transformation

The following policy recommendations are meant to support the government effort to forge a path for Slovakia’s automotive transformation. Their uptake would improve the business environment, facilitate talent and innovations development, with positive spillover effects for unlocking the green and digital transformations across economic sectors and industries:

- Improve general business conditions especially for green projects by speeding up the administrative process and cutting red tape

- Clarify and support eligibility of green projects for EU financing to leverage risk capital

- Integrate EU funds with European Investment Bank (EIB), Slovak Investment Holding (SIH) and commercial loans in consultation with businesses that will use them

- Accelerate implementation of the EU green public procurement (GPP) scheme supporting green innovations, science, and research

- Follow through with ambitious tax reform including ‘1 in 2 out’ principle that was delayed by COVID-19

- Prepare potential greenfield sites (in terms of ownership, change of use etc.)

- Foster collaboration between tech universities and industry and within the wider RDI ecosystem in the region

- Strengthen international university exchanges and collaboration between regional research institutes

- Using dual education and creating new in demand majors at universities

- Develop a strategy for ‘brain drain to brain gain’ in cooperation with universities that removes structural barriers to the Just Transition Fund (JTF)

Governments across the EU and in the Visegrad group have implemented such policies and progress has been made. Some are short-run strategies, including direct government subsidies or loans to attract new production, typically battery gigafactories to the country. Other measures are long-term strategies, like investments in infrastructure and human capital, research and the labour markets, that will help ensure a sustained and long-term competitiveness.

Slovakia will have to balance the short and long-term strategies to maintain its place in the global value chains in the wake of the green transition.

In media:

Euractiv.sk

TA3 (News TV channel)

https://www.ta3.com/clanok/232860/predaj-elektromobilov-je-slabinou-slovenska-ktora-moze-byt-v-buducnosti-problemom

- Covering the report and findings. Reaction of the Slovak Minister of Economy, Mr Richard Sulik

TV Markiza (biggest TV channel)

- Covering the report and findings + recent industry issues with supplies

- Timing: 20:20 - 22:20

Euractiv Podcast

https://euractiv.sk/section/all/news/euractiv-podcast-patrik-krizansky-trh-rozhodol-vodik-v-osobnej-doprave-nema-buducnost/

- Interview with Patrik Krizansky

- covering the report and findings as well as H2 in transportation

Pravda

Parameter (In Hungarian!)

https://parameter.sk/mi-lesz-szlovak-autoiparral-ha-atallunk-az-elektromos-jarmuvekre

Spravy